Do you realize that if you owe $5,600 on a credit card with a 18% interest rate, and you only make $100 payment each month that you will owe on this account for 124 months and pay a total of $6,708.54 in principle and and paying % 54.5031 of interest for the payment?

Real examples are usually the best tool to demonstrate a theory. Let’s take few examples:

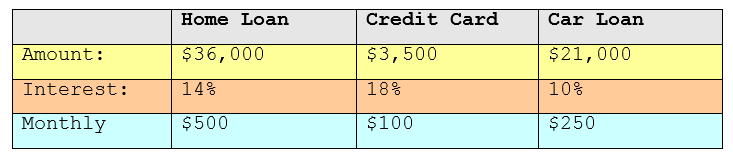

You have 3 debts:

- Home Loan

- Credit Card

- Car Loan

Home loan has an amount of $36.000 with %14 of interest rate, $3500 for the credit card with %18 of interest and $21.000 for the car loan with %10 of interest.

Most people unfortunately, do not summarize their debts correctly. They simply follow the debt period/time and payoff their debts without having a clear status of what is really happening behind the scene.

As an advice, take your calculator, have a paper and do at the same time these examples and you will notice how drastically you can cut down your interests and save time and money!

Let’s summarize these debts:

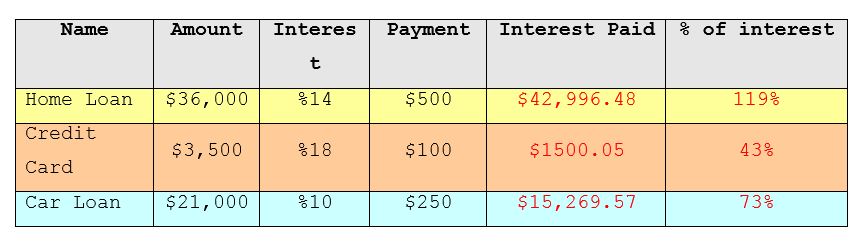

Summary for your current debts:

- $60.500 is the total amount of the debts we have. ($36.000 + $3500 + $21.000)

- 12.8% is the interest rate we are paying. (Weighted average for 14%, 18% and 10%)

- $850 is your current monthly payment. ($500 + $100 + $250)

- $647.50 is the amount of interest you are paying each month. ($60.500 x 12.842% / 12)

- 76.1% is the percent of your monthly payments on all your debts.

If you continue to make the current minimum payments on all your debts, you will be in debt for: 13 years and 2 months

During this time you will pay a total of $59,766.10 in interest which is 98.7% of your current debt!

Can you imagine this huge number! 98.7% of interest!!!

This is the current debt status; this is the nightmare if you do not follow a debt free plan. Shocking numbers!

- Your Home loan needs 13 years and 2 months to be paid off

- Your Car loan needs 12 years and 2 months to be paid off.

- Your Credit card needs 4 years and 3 months to be paid off.

Total: $60.500

Interest: $59.766.10

Can you imagine paying interest approximately the same amount of owe? Unbelievable!

You will be paying for this $120.266, by simply recreating a repayment plan (following steps of Chapter 5), you will save this money! And save time too! And make life easier and let the dream come true!

f you were to pay off your debts by paying either the minimum amount or the payment amount of a 15 year amortization, you would have to pay a total of $59,766.10 in interest and would not pay off your debts for 13 years and 2 months.